A Comprehensive Analysis of Mahindra & Mahindra Holidays Share Price: Factors, Trends, and Insights

Related Articles: A Comprehensive Analysis of Mahindra & Mahindra Holidays Share Price: Factors, Trends, and Insights

Introduction

With great pleasure, we will explore the intriguing topic related to A Comprehensive Analysis of Mahindra & Mahindra Holidays Share Price: Factors, Trends, and Insights. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Analysis of Mahindra & Mahindra Holidays Share Price: Factors, Trends, and Insights

Introduction

Mahindra & Mahindra Holidays & Resorts India Limited (M&M Holidays) is a prominent player in the Indian leisure hospitality sector, offering a unique proposition of timeshare holidays. The company’s share price, like any publicly traded entity, reflects a complex interplay of various factors, including financial performance, industry trends, and broader market sentiment. This article aims to provide a comprehensive understanding of the M&M Holidays share price, analyzing its historical performance, key drivers, and potential future prospects.

Understanding the Company and its Business Model

Mahindra Holidays operates a distinct business model within the hospitality industry. It offers "timeshare" memberships, allowing individuals to own a specific period of stay at various resorts across India and internationally. These memberships offer flexibility and convenience, enabling members to enjoy vacations at their preferred destinations without the hassles of traditional hotel bookings.

Key Drivers of Mahindra & Mahindra Holidays Share Price

Several factors influence the fluctuations in M&M Holidays share price, which can be broadly categorized as follows:

1. Financial Performance:

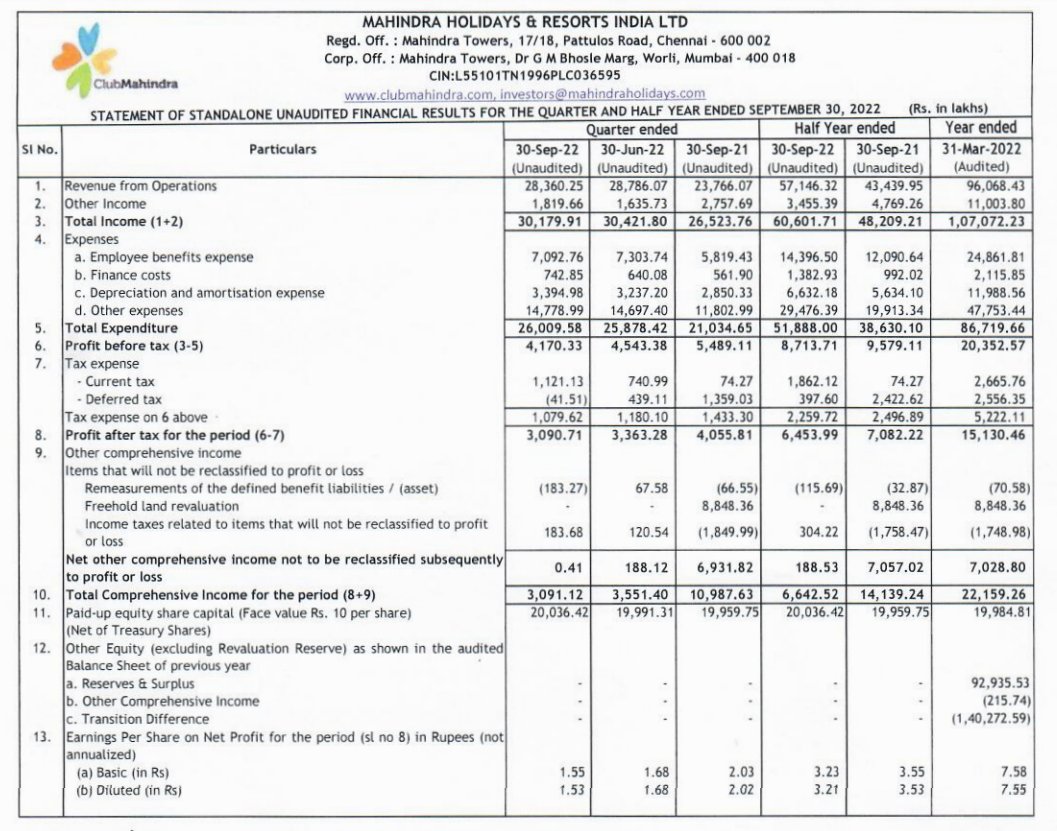

- Revenue Growth: The company’s revenue growth is a primary driver of share price. Increased membership sales, higher occupancy rates, and expansion into new markets contribute to revenue growth, indicating strong financial performance and future potential.

- Profitability: Profitability is another crucial indicator. Higher profit margins, driven by efficient operations and cost management, demonstrate the company’s ability to generate sustainable returns, attracting investors.

- Debt Levels: Lower debt levels signify a stronger financial position, reducing financial risk and enhancing investor confidence.

2. Industry Trends:

- Growing Domestic Tourism: The Indian tourism sector is witnessing significant growth, driven by rising disposable incomes and a burgeoning middle class. This positive trend benefits M&M Holidays as it caters to domestic leisure travelers seeking quality vacation experiences.

- Shifting Travel Preferences: Consumers are increasingly seeking personalized and flexible travel options. M&M Holidays’ timeshare model aligns with this trend, offering customized vacation packages and the convenience of pre-booked accommodation.

- Competition: The leisure hospitality sector is competitive, with players offering diverse accommodation options and travel experiences. M&M Holidays’ ability to differentiate itself through its unique timeshare model and strong brand reputation plays a crucial role in its success.

3. Macroeconomic Factors:

- Economic Growth: A healthy economy translates to higher consumer spending, potentially boosting demand for leisure travel and impacting M&M Holidays’ revenue.

- Interest Rates: Interest rate changes influence borrowing costs for both the company and its customers. Lower interest rates can encourage investment and consumer spending, benefiting M&M Holidays.

- Inflation: High inflation can erode consumer purchasing power, potentially affecting demand for leisure travel and impacting the company’s revenue.

4. Investor Sentiment:

- Market Volatility: Broader market sentiment, influenced by global economic events and investor confidence, can significantly impact share prices. During periods of market uncertainty, investor appetite for riskier assets like M&M Holidays shares may decrease.

- Analyst Recommendations: Analyst ratings and recommendations based on their assessment of the company’s financial performance, future prospects, and industry trends influence investor decisions. Positive ratings can boost share price, while negative ones can lead to price declines.

- News & Events: Company-specific news and events, such as new resort openings, strategic partnerships, or changes in management, can impact investor perceptions and influence share price movements.

Historical Performance of Mahindra & Mahindra Holidays Share Price

Analyzing the historical performance of M&M Holidays share price provides insights into past trends and potential future patterns. The share price has exhibited significant fluctuations over the years, influenced by the factors discussed above.

- Growth Years: The company witnessed a period of strong growth in the early 2000s, driven by increasing demand for timeshare holidays and expansion into new markets. This resulted in substantial share price appreciation.

- Market Corrections: Like most stocks, M&M Holidays share price experienced corrections during periods of economic downturn and market volatility. However, the company’s strong fundamentals allowed it to recover and continue its growth trajectory.

- Recent Performance: In recent years, the share price has been impacted by factors such as the COVID-19 pandemic, competition, and overall market sentiment. However, the company’s resilience and focus on adapting to changing consumer preferences have helped it navigate these challenges.

Potential Future Prospects

Predicting future share price movements is inherently challenging, but understanding the factors influencing M&M Holidays’ performance allows for informed speculation.

- Continued Growth in Domestic Tourism: The ongoing growth in domestic tourism presents a significant opportunity for M&M Holidays. The company’s focus on expanding its network of resorts and offering customized travel packages positions it well to capitalize on this trend.

- Expanding International Presence: M&M Holidays has already established a presence in international markets. Further expansion into new regions, particularly in countries with strong tourism potential, could drive growth and attract investors.

- Digital Transformation: Embracing digital technologies to enhance customer experience, streamline operations, and improve marketing efforts will be crucial for future success.

FAQs Regarding Mahindra & Mahindra Holidays Share Price

Q1: What are the key factors influencing M&M Holidays share price in the short term?

A1: Short-term fluctuations in M&M Holidays share price are primarily driven by factors like quarterly financial results, news announcements, and broader market sentiment. Positive earnings reports, strategic partnerships, or favorable industry developments can lead to price increases, while negative news or market volatility can trigger declines.

Q2: What are the long-term prospects for M&M Holidays share price?

A2: The long-term prospects for M&M Holidays share price are closely tied to the company’s ability to capitalize on the growth in the leisure travel industry, expand its market share, and maintain profitability. Continued investments in new resorts, innovative product offerings, and effective marketing strategies are crucial for sustainable growth and long-term shareholder value creation.

Q3: Is M&M Holidays share price a good investment?

A3: Whether or not M&M Holidays share price is a good investment depends on individual investment goals, risk tolerance, and market outlook. Investors should conduct thorough due diligence, considering factors such as financial performance, industry trends, and company strategy before making any investment decisions.

Tips for Investing in Mahindra & Mahindra Holidays Shares

- Conduct Thorough Research: Before investing, understand the company’s business model, financial performance, and future prospects. Analyze industry trends and competitive landscape to assess the company’s position and potential.

- Consider Your Investment Horizon: Determine your investment timeframe and risk tolerance. M&M Holidays shares may be suitable for long-term investors seeking growth potential, but short-term traders should be aware of potential market volatility.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investment portfolio by including other asset classes and companies to mitigate risk.

- Monitor Your Investment: Regularly review your investment performance and adjust your strategy based on market conditions, company performance, and your investment goals.

Conclusion

The Mahindra & Mahindra Holidays share price is a dynamic indicator of the company’s performance and the overall leisure hospitality sector. Understanding the key drivers of share price, including financial performance, industry trends, and investor sentiment, is crucial for making informed investment decisions. While predicting future movements is challenging, investors can leverage historical data, current market conditions, and company-specific information to make informed assessments. By staying informed and adopting a long-term investment approach, investors can potentially benefit from the growth potential of M&M Holidays in the evolving leisure travel landscape.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Analysis of Mahindra & Mahindra Holidays Share Price: Factors, Trends, and Insights. We thank you for taking the time to read this article. See you in our next article!