Mahindra & Mahindra: A Deep Dive into Share Price Prospects

Related Articles: Mahindra & Mahindra: A Deep Dive into Share Price Prospects

Introduction

With great pleasure, we will explore the intriguing topic related to Mahindra & Mahindra: A Deep Dive into Share Price Prospects. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mahindra & Mahindra: A Deep Dive into Share Price Prospects

Mahindra & Mahindra (M&M), a leading Indian multinational conglomerate, has a long and storied history in the automotive, agricultural, and financial sectors. The company’s performance and future prospects are closely watched by investors, making understanding its share price trajectory a crucial aspect of any investment strategy. This article provides a comprehensive analysis of M&M’s share price, exploring key factors that influence its movement and offering insights into potential future scenarios.

Understanding the Dynamics of M&M’s Share Price

M&M’s share price is a complex interplay of various internal and external factors. These include:

1. Automotive Performance: The automotive sector is the backbone of M&M’s business, contributing significantly to revenue and profits. The company’s performance in the passenger vehicle (PV) and utility vehicle (UV) segments, particularly in the Indian market, plays a major role in shaping investor sentiment. Factors like new model launches, market share gains, and overall industry growth influence the company’s financial health and, consequently, its share price.

2. Tractor Sales: M&M is a dominant player in the Indian tractor market, with a substantial market share. Tractor sales are closely tied to agricultural output and rural economic conditions. Positive trends in agricultural productivity, favorable government policies, and robust monsoon rains can lead to strong tractor demand, impacting M&M’s earnings and share price.

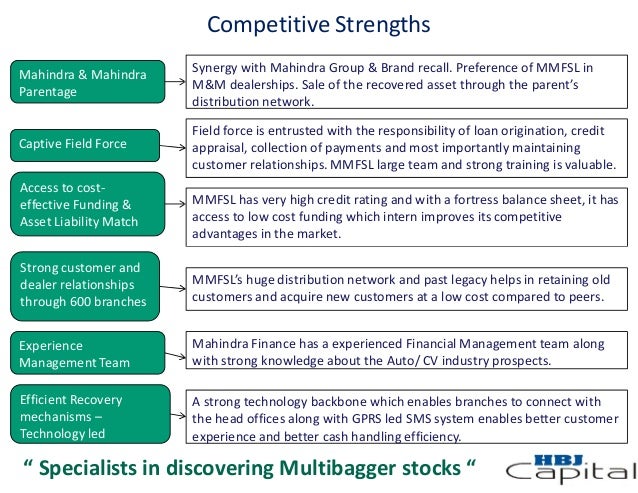

3. Financial Services: M&M’s financial services arm contributes to the company’s overall performance. The performance of its lending operations, asset quality, and growth in the financial services sector have a direct impact on M&M’s financial health and investor sentiment.

4. Global Economic Environment: M&M’s operations extend beyond India, with a presence in international markets. Global economic conditions, including interest rates, commodity prices, and exchange rates, can impact the company’s profitability and share price.

5. Competition: M&M faces competition in both its automotive and agricultural segments. The competitive landscape, including new entrants and the performance of rivals, can influence market share, pricing dynamics, and ultimately, the company’s financial performance.

6. Regulatory Environment: Government policies and regulations, particularly in the automotive and agricultural sectors, can impact M&M’s business operations. Changes in emission norms, fuel regulations, and agricultural policies can influence the company’s investment decisions, production costs, and overall profitability.

7. Technological Advancements: The automotive industry is rapidly evolving, driven by technological advancements like electrification, autonomous driving, and connected vehicles. M&M’s ability to adapt to these changes, invest in research and development, and launch innovative products will be crucial in determining its long-term competitiveness and share price performance.

Analyzing M&M’s Share Price Target

Predicting a specific share price target for M&M is a complex exercise, requiring a nuanced understanding of the factors mentioned above. However, a thorough analysis can provide insights into potential future scenarios.

Key Drivers for Future Growth:

- Strong Domestic Demand: The Indian automotive market is expected to continue growing, driven by rising disposable incomes, urbanization, and increasing demand for personal mobility. M&M’s strong brand recognition and presence in the SUV segment position it well to benefit from this growth.

- Focus on Rural Economy: The Indian government’s emphasis on rural development and agricultural infrastructure can boost demand for tractors and farm machinery, benefiting M&M’s agricultural equipment business.

- Expansion in Financial Services: M&M’s financial services arm has potential for growth, driven by increasing penetration of financial services in rural areas and the company’s established customer base.

- Electric Vehicle (EV) Push: M&M is investing in the development and production of electric vehicles, positioning itself to capitalize on the growing EV market in India and globally.

- International Expansion: M&M’s international operations, particularly in South Africa and Southeast Asia, offer opportunities for growth and diversification.

Challenges to Consider:

- Competition: The Indian automotive market is increasingly competitive, with established players and new entrants vying for market share. M&M will need to maintain its competitive edge through innovation and product differentiation.

- Commodity Prices: Fluctuations in commodity prices, particularly steel and aluminum, can impact M&M’s production costs and profitability.

- Regulatory Changes: Government policies and regulations, including stricter emission norms and fuel efficiency standards, can impact M&M’s product development and manufacturing costs.

- Economic Volatility: Global economic uncertainties and geopolitical tensions can impact consumer sentiment and demand for automobiles, affecting M&M’s performance.

Forecasting Share Price Movements

Based on the factors discussed above, analysts and investors use various methods to forecast M&M’s share price movements. These methods include:

- Fundamental Analysis: Examining the company’s financial statements, market position, competitive landscape, and industry trends to assess its intrinsic value and potential for growth.

- Technical Analysis: Studying historical price patterns, trading volumes, and other technical indicators to identify potential trends and predict future price movements.

- Sentiment Analysis: Gauging investor sentiment and market sentiment through news reports, analyst ratings, and social media trends to understand market expectations and potential price reactions.

Understanding the Importance of Share Price Target

A share price target, while not a guarantee, provides a benchmark for investors to evaluate potential returns and make informed decisions. It helps them:

- Set Investment Goals: Investors can use share price targets to set realistic expectations for their investments and align their portfolio with their financial objectives.

- Manage Risk: Understanding potential share price movements allows investors to assess risk and adjust their investment strategies accordingly.

- Compare Investment Options: Share price targets can help investors compare different investment opportunities and choose those that offer the most attractive risk-reward profile.

FAQs on M&M Share Price Target:

Q1. What are the key factors that influence M&M’s share price target?

A1. M&M’s share price is influenced by a combination of factors, including the performance of its automotive and tractor businesses, the overall economic environment, competition, and technological advancements.

Q2. What are the potential drivers for growth in M&M’s share price?

A2. Strong domestic demand for automobiles, growth in the rural economy, expansion in financial services, investment in electric vehicles, and international expansion are key drivers for future growth.

Q3. What are the challenges that could impact M&M’s share price target?

A3. Challenges include intense competition, fluctuations in commodity prices, regulatory changes, and global economic uncertainties.

Q4. How can investors forecast M&M’s share price target?

A4. Investors can use fundamental analysis, technical analysis, and sentiment analysis to forecast potential share price movements.

Q5. Why is understanding M&M’s share price target important for investors?

A5. Understanding share price targets helps investors set investment goals, manage risk, and compare different investment opportunities.

Tips for Investing in M&M:

- Conduct thorough research: Understand the company’s business model, financial performance, and future prospects before investing.

- Consider your investment goals and risk tolerance: Align your investment strategy with your financial objectives and risk appetite.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes and sectors.

- Stay informed about market developments: Monitor industry trends, company news, and economic indicators to stay informed about potential risks and opportunities.

- Seek professional advice: Consult with a financial advisor to get personalized guidance on your investment strategy.

Conclusion:

M&M’s share price is a reflection of its financial performance, market position, and future prospects. The company’s strong domestic presence, growth potential in the automotive and agricultural sectors, and strategic investments in electric vehicles and financial services offer opportunities for growth. However, investors need to consider the challenges posed by intense competition, commodity price volatility, regulatory changes, and global economic uncertainties. By carefully analyzing the factors influencing M&M’s share price and understanding the potential drivers and challenges, investors can make informed decisions about their investment strategy.

Closure

Thus, we hope this article has provided valuable insights into Mahindra & Mahindra: A Deep Dive into Share Price Prospects. We hope you find this article informative and beneficial. See you in our next article!